The analysis provides an overview of the implementation of the system “percentage of the income tax” in Hungary, Slovakia, Lithuania, Poland, Romania and the Czech Republic. It allows the person declaring their income to channel 1-2 percent of the income tax to chosen organisations. In addition, analysis was conducted on the situation of charity and donating in Estonia; predictions were made in regard to its potential development. The effects of different income tax channelling mechanisms were also investigated, resulting in two possible models for Estonia.

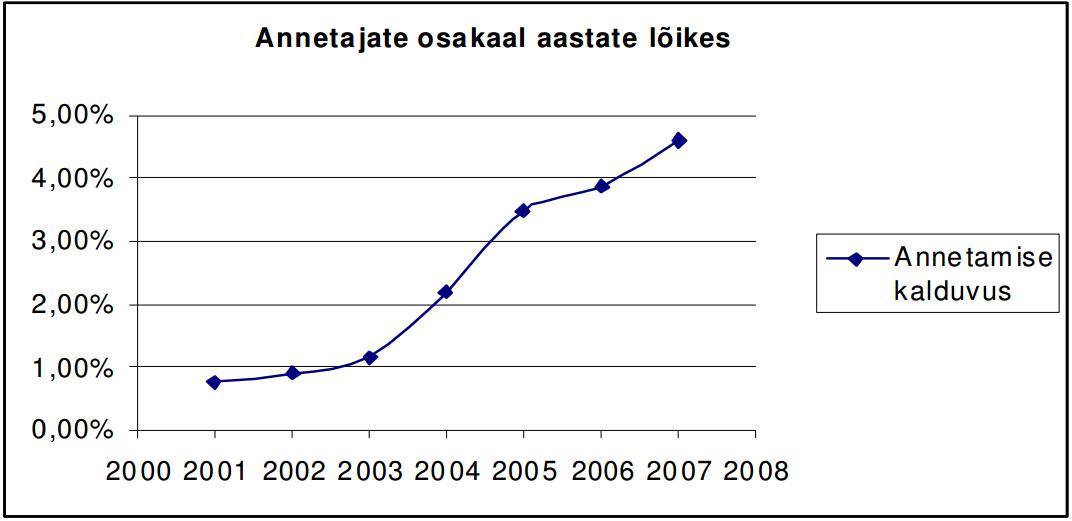

Graph: The proportion of donors per year per individual declaration of income.

It follows from the analysis that the states that have implemented the system of channelling a percentage from the income tax have done so for different reasons:

- To increase the funds allocated to non-governmental organisations;

- To strengthen ideation regarding charity and do-gooding;

- To strengthen the relationships between non-governmental organisations with their target audiences and the public;

- To decentralise and depoliticise the allocation of funds;

- To raise the efficiency of the usage of public funds;

- To increase the civic participation of the citizenry by allowing them the chance of immediate decision-making in regard to the usage of tax money.

The system has born the clearest influence on strengthening the NGOs: percentage system has forced the organisations to behave more inclusively and transparently, to think through their activities and resultant effectiveness and to strengthen their competency and team as a result. In countries where the culture of charity is relatively underdeveloped, the organisations had previously lacked monetary incentives for paying attention to aforementioned relationships and the need for intra-organisation development. In result, however, the public has become more aware of the responsibilities and dealings of the NGOs.

“In the countries under analysis, charity has increased during the implementation of the percentage system.” –Kristina Mänd

The models on offer for Estonia:

I Model–The development of individual donating culture and charity in addition to channelling a percentage of the income tax. Tries to strike a balance between supporting administrative areas and small or big non-governmental organisations.

II Model–Develops the individual charity culture and the civic society in general.